How to sell software legally in the US sets the stage for this enthralling narrative, offering readers a glimpse into the intricate landscape of software sales. Navigating the legal requirements, licensing models, tax obligations, and marketing strategies can seem daunting, but understanding these elements is crucial for success. This guide will equip you with the knowledge to ensure your software sales are compliant, effective, and profitable.

From securing the necessary licenses to choosing the right distribution channels, every step is essential for establishing a legitimate software business. With the right information at your fingertips, you can confidently embark on your journey to sell software while adhering to legal standards and maximizing your market impact.

Legal Requirements for Selling Software in the US

Selling software in the United States demands a thorough understanding of legal requirements to ensure compliance and protect your business. This section Artikels essential licenses, permits, and regulations that software sellers must adhere to in order to operate legally.

Necessary Licenses and Permits

Before selling software, it is crucial to obtain the necessary licenses and permits. Software businesses may require:

- Business license: A general license to operate within your city or state.

- Sales tax permit: Required in many states for collecting sales taxes on software sales.

- Copyright registration: Although not mandatory, registering your software can provide legal advantages in the event of infringement.

Compliance with Federal and State Regulations

Compliance with various regulations is essential. The Federal Trade Commission (FTC) enforces rules regarding marketing and advertising, while state laws may dictate additional requirements for consumer protection. Failure to comply can lead to legal consequences.

Intellectual Property Rights in Software Sales, How to sell software legally in the US

Intellectual Property (IP) rights, including copyrights and trademarks, play a pivotal role in software sales. Properly protecting your software ensures that you retain ownership and control over its use, preventing unauthorized distribution and duplication.

Software Licensing Models

Choosing the right software licensing model is critical for both the business and its customers. Different models cater to varied market needs and can significantly affect revenue and customer satisfaction.

Perpetual vs. Subscription-Based Licensing

Perpetual licensing allows customers to pay a one-time fee for indefinite access to the software, while subscription-based licensing involves recurring payments for ongoing access and updates. Each model has its advantages:

- Perpetual licensing often yields higher initial revenue.

- Subscription models provide consistent cash flow and ongoing customer engagement.

Open-Source vs. Proprietary Software Licenses

Open-source licenses allow users to modify and share the software, fostering community collaboration. In contrast, proprietary licenses restrict access to the source code and maintain tighter control over the software’s use. Each approach has implications for distribution and user engagement.

User Agreements and EULAs

Creating clear user agreements and End User License Agreements (EULAs) is essential to inform customers about their rights and responsibilities. Best practices include:

- Using straightforward language to ensure clarity.

- Defining limitations on liability and usage rights.

- Including terms on updates, support, and termination of service.

Tax Obligations When Selling Software

Understanding tax obligations is vital for software sellers to maintain compliance and avoid legal penalties. This section covers the types of taxes that may apply and how to manage them effectively.

Types of Taxes on Software Sales

Different states impose various taxes on software sales. Common taxes include:

- Sales tax: Applicable in many states for tangible and downloadable software.

- Use tax: A tax on goods purchased out of state but used in the home state.

- Income tax: Tax on profits derived from sales.

Determining Appropriate Sales Tax

To determine the correct sales tax for software products, businesses must consider:

- The state where the customer resides.

- The nature of the software (tangible vs. digital).

- Local tax rates, which can vary widely.

Digital Goods Taxation Compliance

Digital goods taxation varies across states, creating a complex legal landscape. Compliance requires businesses to stay informed about local tax laws and ensure that they are collecting the correct amounts.

Distribution Channels for Software Sales

Selecting the right distribution channel can significantly impact a software business’s success. This section organizes various channels available for software sales.

Online Marketplaces and Direct Sales

Different distribution channels offer unique advantages and disadvantages:

- Online marketplaces (e.g., Shopify, Amazon): Provide access to a large audience but may charge fees.

- Direct sales: Allow for better customer relationships and higher profit margins but require more marketing effort.

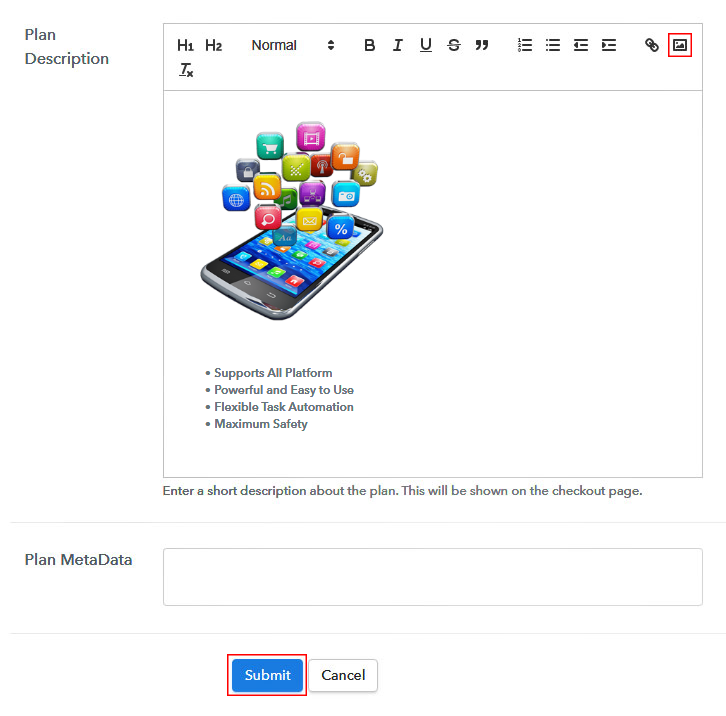

Popular Platforms for Software Distribution

The following table summarizes popular software distribution platforms and their features:

| Platform | Features |

|---|---|

| Amazon | Large customer base, marketing tools, fulfillment services |

| Shopify | E-commerce focused, customizable store, payment integration |

| Microsoft Store | Access to Windows users, built-in payment processing |

Marketing Software Legally

Marketing software effectively while adhering to legal guidelines is paramount for success. This section Artikels strategies for legal and ethical marketing.

Effective Marketing Strategies

Successful marketing strategies must comply with legal standards. Consider the following:

- Utilizing accurate and truthful advertising to avoid misleading claims.

- Ensuring that all promotional materials align with FTC regulations.

- Maintaining transparency about pricing and terms of service.

Privacy Policies and Customer Data Protection

A robust privacy policy is necessary to protect customer data and comply with various regulations. It should clearly Artikel how customer information is collected, used, and stored.

Discover unbeatable value with our selection of refurbished monitors in the USA. These high-quality devices deliver stunning visuals at a fraction of the cost, making them perfect for both work and play. Don’t miss out—check out the amazing deals and find your ideal monitor today at Buy refurbished monitors USA.

Handling Customer Support and Returns

Providing exceptional customer support and a clear return policy is vital for maintaining customer satisfaction and legal compliance.

Legal Obligations for Customer Support

Software sellers are obligated to provide support for their products. This includes:

- Offering timely responses to customer inquiries.

- Providing updates and bug fixes as necessary.

- Implementing a robust system for tracking support requests.

Establishing a Clear Return Policy

A clear return policy helps set expectations for customers. It should specify:

- Conditions under which returns are accepted.

- Timeframes for returns and refunds.

- Procedures for initiating a return.

International Selling Considerations

Selling software internationally introduces additional complexities, including compliance with various regulations and payment processing challenges.

When it comes to investing in software, understanding the software warranties and refund policies is essential. Protect your purchase and ensure peace of mind with clear terms and support options. Make sure you’re informed to get the best value from your software investments.

Regulations for International Sales

When selling to international customers, businesses must consider:

- Import/export regulations specific to software.

- Local laws governing software distribution and sales.

- Compliance with international privacy laws, such as GDPR.

GDPR and International Privacy Laws

Compliance with the General Data Protection Regulation (GDPR) is essential for businesses dealing with European customers. This includes obtaining explicit consent for data collection and implementing data protection measures.

Ready to enhance your productivity? Our comprehensive Google Workspace subscription buying guide provides all the insights you need to choose the right plan for your needs. From collaboration tools to cloud storage, we’ve got you covered—start your journey toward seamless teamwork today!

Payment Processing Challenges

Payment processing can vary significantly by country. Businesses must address:

- Currency conversion and transaction fees.

- Local payment preferences and methods.

- Compliance with local tax regulations for digital goods.

Frequently Asked Questions: How To Sell Software Legally In The US

What licenses are needed to sell software in the US?

Generally, you will need a business license and possibly software-specific licenses, depending on your state.

Are there specific taxes for selling software?

Yes, sales tax varies by state and may also depend on whether the software is considered a tangible product or a service.

Can I sell software internationally?

Yes, but it’s important to comply with international regulations, such as GDPR, and understand payment processing in other countries.

What is an EULA?

An EULA, or End User License Agreement, Artikels the terms under which users can use your software, protecting your intellectual property.

How do I handle customer returns for software?

Establish a clear return policy that complies with legal standards and clearly communicates the terms to your customers.