Best bookkeeping software for startups in America is an essential tool designed to streamline financial management and drive business success. As startups navigate the challenging landscape of entrepreneurship, effective bookkeeping becomes crucial in maintaining accurate records, ensuring compliance, and making informed decisions. The right software not only simplifies these tasks but also provides valuable insights that can propel your business forward.

In today’s fast-paced environment, startups can no longer rely on traditional bookkeeping methods. With a variety of software options available, it’s important to explore the features, benefits, and pricing models that can cater specifically to the needs of new businesses. From automation to integration with other tools, the right bookkeeping software can significantly enhance productivity and financial clarity.

Overview of Bookkeeping Software for Startups: Best Bookkeeping Software For Startups In America

In today’s fast-paced business environment, efficient financial management is critical for startups in America. Bookkeeping software has become an essential tool for burgeoning entrepreneurs, allowing them to streamline their financial processes and focus on growth. By automating tedious tasks, startups can save time and reduce the risk of errors that come with manual bookkeeping.The importance of bookkeeping software lies in its ability to offer comprehensive solutions that encompass various financial functions.

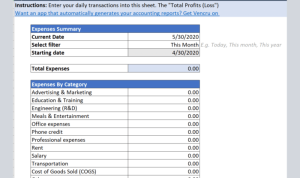

Common features often include expense tracking, invoicing, bank reconciliation, and financial reporting. These functionalities not only simplify accounting processes but also provide startups with valuable insights into their financial health.Utilizing bookkeeping software over traditional methods presents key benefits. This software enhances accuracy, provides real-time data access, and can scale as the business grows. By implementing these tools, startups can enjoy a more organized financial structure, ultimately paving the way for better decision-making and strategic planning.

Top Bookkeeping Software Options for Startups

To help startups make an informed choice, here’s a comparison of top bookkeeping software options available in America. Each option offers unique features tailored to different business needs.

| Software | Features | Pricing | Strengths | Weaknesses |

|---|---|---|---|---|

| QuickBooks | Invoicing, Expense Tracking, Reporting | $25/month | User-friendly interface, Extensive integrations | Can be pricey for advanced features |

| Xero | Bank Reconciliation, Invoicing, Inventory Tracking | $12/month | Great for collaboration, Strong mobile app | Limited customer support options |

| FreshBooks | Time Tracking, Invoicing, Expense Management | $15/month | Excellent customer service, Easy to use | Limited features for larger businesses |

User testimonials highlight the strengths of these options. For instance, QuickBooks users often praise its comprehensive reporting capabilities, while FreshBooks is recognized for its exceptional customer support.

Key Features to Look for in Bookkeeping Software

When selecting bookkeeping software, startups should prioritize essential features that align with their operational needs. Key functionalities include:

- Automated invoicing and payment reminders

- Expense tracking and categorization

- Real-time financial reporting and analytics

- Bank reconciliation tools

- Multi-currency support for international transactions

Scalability and integration capabilities are crucial. As businesses evolve, they require software that can grow with them and seamlessly integrate with tools like CRM systems and project management software. To evaluate bookkeeping software solutions effectively, consider the following checklist:

- Does it offer essential features for your business model?

- Is the user interface intuitive and easy to navigate?

- Can it integrate with other tools you currently use?

- What customer support options are available?

- Does it allow for multi-user access?

Pricing Models of Bookkeeping Software

Different bookkeeping software providers offer various pricing models tailored to different business needs. Common models include:

- Subscription-based pricing: Typically charged monthly or annually, this model provides regular updates and support.

- One-time fee: A single upfront payment for perpetual software use, though updates may incur additional costs.

Subscription-based pricing is becoming increasingly popular as it allows startups to access the latest features without significant upfront investment. The potential return on investment (ROI) from adopting quality bookkeeping software includes improved financial accuracy, time savings, and enhanced decision-making capabilities.

Challenges when Choosing Bookkeeping Software

Startups often encounter several challenges in selecting bookkeeping software. These challenges include:

- Identifying the right features that meet specific business needs.

- Budget constraints limiting options.

- Overwhelming choices leading to confusion.

To overcome these challenges, startups should conduct thorough research, seek recommendations, and utilize free trials to test software compatibility. Additionally, robust user support and accessible resources are crucial during the selection process. Engaging with user communities and forums can also provide valuable insights.

Integration with Other Business Tools

Bookkeeping software can significantly enhance operational efficiency by integrating with other business tools, such as customer relationship management (CRM) systems and project management software. Such integrations allow for seamless data sharing and improved workflow.For example, Xero integrates well with CRM platforms like Salesforce, enabling startups to streamline their sales and accounting processes. The benefits of having an integrated system include reduced data entry errors, improved accuracy, and a holistic view of business performance.

Best Practices for Implementing Bookkeeping Software, Best bookkeeping software for startups in America

Successful implementation of bookkeeping software involves several critical steps:

- Assess current financial processes and identify areas for improvement.

- Choose the right software based on the evaluation checklist.

- Train staff thoroughly on the new system to ensure smooth adoption.

Creating a timeline for transitioning from manual bookkeeping to software-based practices is essential. This timeline should include milestones such as data migration, staff training sessions, and regular check-ins to assess progress.

Deciding between software subscriptions vs one time purchase ? Consider the flexibility of subscriptions that offer regular updates and support against the one-time purchase for long-term savings. Choose what fits your business needs best and maximize your investment today!

Future Trends in Bookkeeping Software

Emerging technologies are poised to reshape bookkeeping software for startups. Automation is becoming increasingly powerful, allowing for more efficient data entry and transaction processing. Additionally, artificial intelligence (AI) is enhancing predictive analytics, enabling startups to anticipate financial trends and make informed decisions.As these trends evolve, startups in America can expect a more streamlined experience with bookkeeping software, ultimately leading to greater efficiency and scalability in financial management.

Embracing these innovations will be essential for startups looking to stay competitive in an ever-changing business landscape.

Unlock your company’s potential with the best CRM software for US companies. Enhance customer relationships and streamline processes with tools tailored for success. Don’t miss out on elevating your business operations—discover the perfect CRM solution now!

User Queries

What should I consider when choosing bookkeeping software?

Consider features like automation, integration, scalability, user support, and pricing models that fit your startup’s budget and growth plans.

Are there free bookkeeping software options available?

Yes, several free or low-cost bookkeeping software options are available, but they may have limited features compared to paid solutions.

How can bookkeeping software benefit my startup?

Bookkeeping software helps automate financial tasks, minimizes errors, improves compliance, and provides real-time insights into your business’s financial health.

Transform your living space into a modern oasis with the best deals on smart home hardware. Whether you’re looking for smart lighting, security systems, or energy-efficient gadgets, there’s never been a better time to upgrade your home. Experience convenience and connectivity like never before!

Is training necessary for using bookkeeping software?

While many software options are user-friendly, training can significantly enhance your team’s efficiency and ensure they maximize the software’s capabilities.

Can bookkeeping software integrate with other business tools?

Yes, most modern bookkeeping software can integrate with tools like CRMs, project management software, and payment processors, creating a seamless workflow.